Questions You May Have About Selling Your House

There's no denying mortgage rates are having a significant impact on today's housing market. And that may leave you with some questions about whether it still makes sense to sell your house and make a move.

Here are three top questions you may be asking – and the data that helps answer them.

1. Should I Wait To Sell?

If you're considering waiting to sell until after mortgage rates come down, here's what you need to know. So are a ton of other people.

And while mortgage rates are still forecasted to come down later this year, if you wait for that to happen, you may be dealing with a lot more competition as other buyers and sellers jump back in, too. As Bright MLS says:

“Even a modest drop in rates will bring both more buyers and more sellers into the market.”

If you wait it out, you'll have to deal with faster price rises and multiple-offer scenarios when buying your next home.

2. Are Buyers Still Out There?

But that doesn't mean no one is moving right now. While some people are holding off, there are still plenty of buyers active today. And here's the data to prove it.

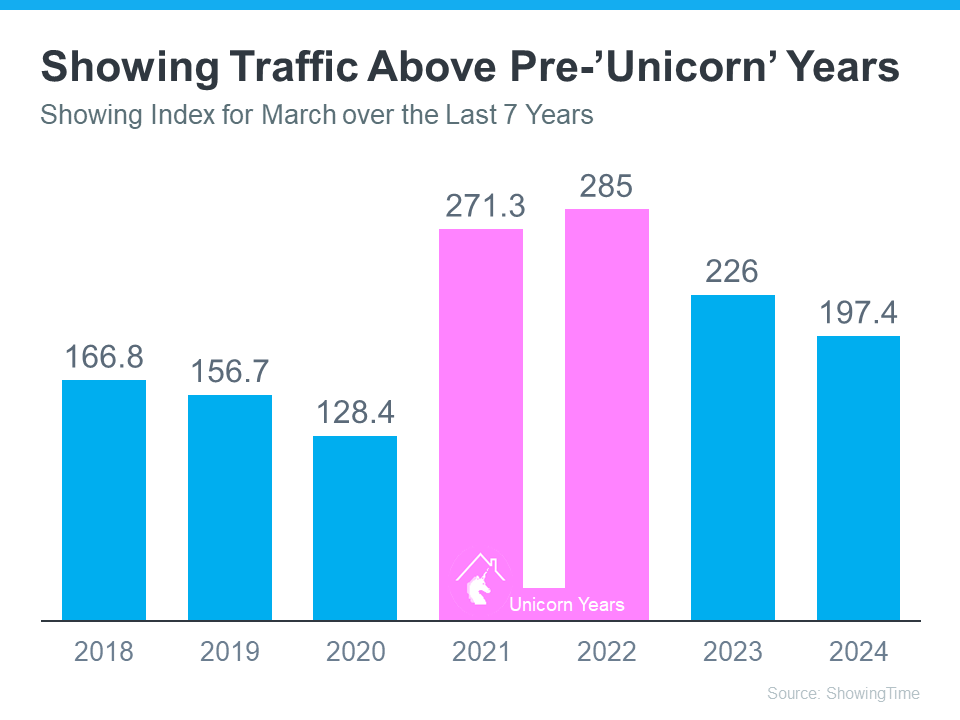

The ShowingTime Showing Index measures how frequently buyers are touring homes. The graph below uses that index to show buyer activity for March (the latest data available) over the past seven years:

Demand has dipped slightly since the 'unicorn' years (shown in pink). This is due to many market factors, like higher mortgage rates, rising prices, and limited inventory. But to understand today's demand, you must compare it with the last average years in the market (2018-2019)—not the abnormal 'unicorn' years.

You can understand how 2024 stacks up by focusing on just the blue bars. And that gives you a whole new perspective.

Nationally, demand is still high compared to the last average years in the housing market (2018-2019). And that means there's still a market for your house to sell.

3. Can I Afford To Buy My Next Home?

And if you're worried about how you'll afford your next move with today's rates and prices, consider this: you probably have more equity in your current home than you realize.

Homeowners have gained record amounts of equity over the past few years. And that equity can make a big difference when you buy your next home. You may have enough to be an all-cash buyer and avoid taking out a mortgage altogether. As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“ . . . those who have earned housing equity through home price appreciation are the current winners in today's housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.”

Bottom Line

If these three questions have been on your mind and have been holding you back from selling, hopefully, this information will help. A recent survey from Realtor.com shows that more than 85% of potential sellers have been considering selling for over a year. That means several sellers like you are on the fence.

However, that same survey also interviewed sellers who recently decided to list. 79% of those recent sellers wish they'd sold sooner.

Let's connect if you want to discuss any of these questions or need more information.